By Cary Carbonaro Originally written for and published by CFP.

It’s summertime, and everyone is feeling good! Not many people are thinking about financial planning right now. Usually, clients like to think about money during tax season, at the beginning of the year and in the fall. Although clients typically don’t want to meet in the summer, this is a great time to schedule a check-in. Having a mid-year check-in with your CERTIFIED FINANCIAL PLANNER™ professional is essential to your financial planning process for several reasons:

- Assessing progress: A mid-year check-in allows you to evaluate your progress toward your financial goals. It provides an opportunity to review any changes in your circumstances or financial situation and determine if you are on track to achieve your plan objectives. This assessment helps you determine if you need to adjust your financial plan.

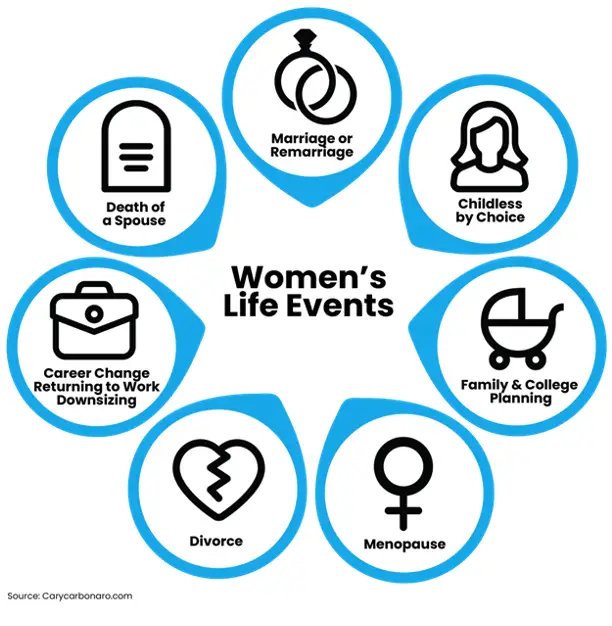

- Making necessary adjustments: Life events, market fluctuations or changes in personal circumstances can all impact your financial plan. By having a mid-year check-in, you can figure out what you need to adjust and how to do so. A check-in helps ensure that your financial strategy aligns with your current goals and circumstances.

- Reviewing investments: Regularly reviewing your investment portfolio is crucial to ensure that it is aligned with your risk tolerance and long-term financial objectives. A mid-year check-in allows your CFP® professional to assess the performance of your investments, rebalance them if necessary and make any strategic changes to optimize your portfolio’s performance.

- Tax planning: A mid-year review is an opportune time to evaluate potential tax-saving strategies. Your CFP® professional can help identify tax-efficient investment options, maximize deductions, and ensure that you are taking advantage of any available tax benefits. This proactive financial approach can potentially optimize your tax situation and minimize your tax liability.

- Strengthening your relationship: Regular check-ins foster a strong relationship between you and your CFP® professional. They provide the opportunity to address any financial concerns, ask questions and gain a better understanding of your financial plan. The more your CFP® professional understands your goals and concerns, the better they can tailor their advice and recommendations to meet your specific needs.

Annual checkups may not be enough — the financial landscape is always changing. For example, in the first half of 2023 the federal government raised interest rates, we experienced double-digit inflation, and the market rose, but only for a handful of stocks. For the first time in years, we also have interest rates of 5% on some bank accounts, Treasury bills and CDs. I advise my clients to take advantage of this by moving money around to maximize savings rates. If clients wait a year, they could miss six months of higher interest.

Overall, a mid-year check-in with your CFP® professional helps ensure that your financial plan remains up-to-date, relevant and aligned with your goals. It allows you to address any changes, make necessary adjustments and receive guidance from a qualified professional to optimize your financial well-being

If you aren’t working with a CFP® professional yet, find yours today!