As generations of women come into their own amid the great wealth transfer, advisors who lean on empathy and language for trust-building are poised for a defining opportunity.

DEC 16, 2025

By Cary Carbonaro | Read Original Post Here

For years, our industry has talked about the “rise of the female investor” as if it were a future trend.

It’s not the future anymore. It’s here.

Over this decade, women are projected to control roughly two-thirds of the nation’s wealth. They are inheriting from parents and spouses, building companies, negotiating equity, launching businesses, and increasingly becoming the primary financial decision-makers at home.

So the question for our profession is simple: Are we adapting to serve women clients in ways that reflect their needs, goals, and experiences?

In my book, “Women and Wealth: A Playbook to Empower Clients and Unlock Their Fortune,” I argue that women don’t just want a different portfolio; they want a different client experience. And advisors who understand that empathy is the new alpha may have the potential to be the ones who win in 2026 and beyond.

Here are five reasons I believe 2026 will be the year of the woman client and what that means for advisors.

1. The Great Wealth Transfer has arrived – and women are at the center of it

We’ve all seen the estimates of trillions of dollars moving between generations. What often gets overlooked is who is stewarding that wealth along the way: Women.

Widows, daughters, and daughters-in-law are stepping into decision-making roles involving complex estates, businesses, concentrated stock positions, and investment portfolios. Late-life divorce is also transferring significant wealth to women, many of whom were not the primary financial decision-maker during their marriage.

For advisors, this presents both a retention risk and a growth opportunity. If you haven’t built meaningful relationships with the women in a household, the probability of assets leaving after a transition is high. But when you have established trust, 2026 can be a breakout year for long-term engagement and referrals.

2. Women clients want to be educated, listened to and not pressured.

When women change advisors, it’s rarely because of performance. It’s because of how they were made to feel.

I hear comments like:

- “He talked at me, not with me.”

- “He only made eye contact with my husband.”

- “I felt rushed or embarrassed asking questions.”

Women are increasingly turning away from the old advisory model built around a single breadwinner and a sales-led meeting. They want partnership, not pressure. They want to be educated, not overwhelmed. They want to be treated as full participants in the financial conversation.

That’s why empathy is the new alpha. When you listen to her story, understand her fears (including the classic “bag-lady” fear), and connect her money to her life, you create an advisor-client relationship built on trust, not transactions.

3. Women’s health and longevity are reshaping planning conversations

In “Women and Wealth,” I explore the connection between women’s health and women’s financial realities.

Statistics from the Centers for Disease Control and Prevention, the primary public health agency in the US, show a significant gap in lifespan, with an average life expectancy of 81.1 years for women and 75.8 years for men as of 2023.

A still-growing body of evidence shows women live longer, spend more years single due to widowhood or divorce, and frequently shoulder caregiving responsibilities for children, aging parents, or both. By some measures, their career interruptions and caregiving years contribute to a lifetime wealth gap of over $1 million.

That means planning for women requires a broader lens, including:

- Long-term care planning and caregiving costs

- Income durability into advanced age

- Honest conversations about the possibility of navigating retirement alone

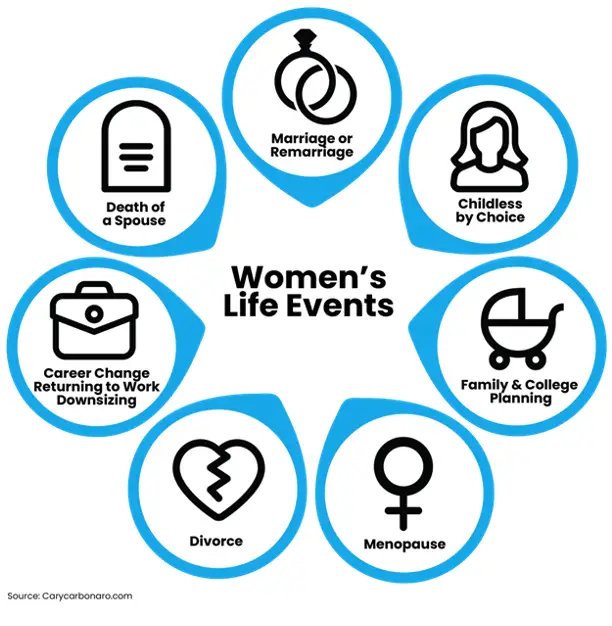

- Addressing major life stages, including menopause and its financial implications

Women clients are increasingly aware of these realities and want advisors who can engage these topics with sensitivity.

4. Younger women are owning the “client” identity earlier than ever

The old stereotype that women only engage with advisors when something goes wrong is fading fast.

Younger women today are:

- Opening brokerage accounts, HSAs, and Roth IRAs independently

- Negotiating salary, equity, and benefits with confidence

- Seeking advisors, both female and male, who respect their goals and autonomy

And they are asking deeper questions:

- “How do I build freedom and options into my life now?”

- “How do I ensure I’m never financially trapped?”

- “How can my money align with my values and priorities?”

They are also far less willing to tolerate being talked down to or sidelined in meetings. For advisors, 2026 represents a pivotal moment: the chance to build lifelong relationships with these clients or risk losing them to advisors and platforms designed specifically for them.

5. Language is now a key differentiator – and a trust builder

If empathy is the new alpha, language is how it shows up in every client conversation. The words we use may either open the door to deeper engagement or quietly erode trust.

Phrases that may build trust:

- “Tell me what’s on your mind about money right now.”

- “My role is to educate and guide you, not to pressure you.”

- “How does this decision support the life you want now and in the future?”

- “It’s completely normal to feel uncertain. Let’s walk through it together.”

Phrases that may break trust:

- “Just trust me; I’ve got this.”

- “We usually talk to your husband about that.”

- “Don’t worry about the details; it’s too complicated.”

Often, the difference between a woman who leans into the planning process and one who quietly disengages is a single sentence. In my own career, one of the most meaningful transformations I made wasn’t a new model or tool; it was changing the way I communicated with women about money.

My guiding principle for advisors is simple: Compel her….don’t sell her. Compelling her means listening, educating, and designing a plan she genuinely believes in.

The opportunity in front of the profession

As women prepare to control the majority of the nation’s wealth, 2026 could be a defining year for advisors and firms.

That means:

- Bringing empathy, curiosity, and respect to every meeting

- Training teams to understand women’s financial experiences and concerns

- Measuring success not only by AUM, but by engagement, retention, and referrals from women clients

In my opinion, the feminization of wealth is not a trend; it’s a structural shift. Advisors who learn to speak to women clients, not around them, will look back on 2026 as a turning point.

The wealth is moving. Women are ready. The real question is whether the industry is ready too.