Here’s what female clients need from advisors, and some questions to evaluate how well you are serving them.

By Cary Carbonaro | April 29, 2025 | Read Original Post

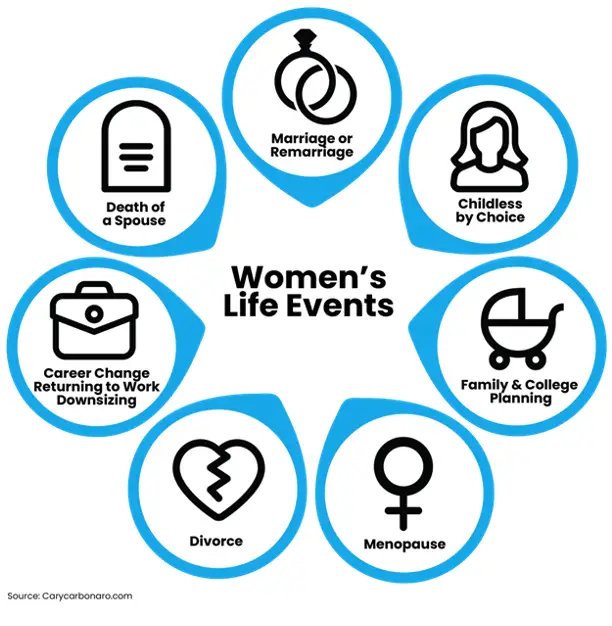

Women need planning more, not less, than men! They typically live longer, earn less, save less, invest more conservatively and spend more money on healthcare! In fact, 90% of women will be responsible for their finances exclusively at one point in their lives. Women are more complex clients than men who generally want to know how much they beat the S&P 500. In my entire three-decade career, I have never had a women ask me that.

A financial advisor’s job is inherently quantitative. But money is deeply personal, and the process of planning most often involves a client’s complex relationship with money. Planners who can engage with these emotions can motivate clients, plan more holistically, and improve planning outcomes.

Some people talk about the softer side of financial planning. It is interesting that there is really no definition for this. “Softer” typically means emotional or touchy-feely stuff that women are usually better at. Connecting with clients on a deeper emotional level or making them part of your world can be especially important with female clients.

Getting Started

That said, you shouldn’t assume that every female client is emotional and touchy feely. You have to get to know them individually. Every person is different in how they approach money and what they want out of an advisor relationship.

One of my clients was very nervous when I first met her, in her early seventies. She thought she didn’t have enough money and was afraid of the stock market. Each time we met, I showed her a year-over-year graph of her net worth. It rose most years, except for 2008. She spent less than she made and her investments were in a 60/40 balanced portfolio. She always asked me, “How much do I have?” I responded by showing her the graphs and telling her she was OK. Every time, she relaxed a little more. Now, after 20 years working together, she says she can sleep and she never worries anymore, at least about money.

Related Posts:

- DoubleLine Fixed Income Briefing

- Female Rainmakers Reveal Secrets to Success

- Motivating Women Advisors to Stay

- Market Scout – Mega-Caps Could Be Passing the Baton to Small-Caps

Powered by Contextual Related Posts

You may also want to consider sharing some details of your life and your goals with your female clients to build trust and lead by example. Advice coming from a trusted friend who is also a fiduciary to me is above reproach. If you always put your clients’ interest first and don’t have conflicts of interest, it makes it easy to deliver and implement.

Who is Responsible?

Women are not taught to believe in financial abundance — that they can create wealth by taking calculated risk and making investments. This is why most women will pick a guaranteed salary over unlimited upside with zero salary. Nor are women generally taught that they can create social and economic capital though financial literacy and taking responsibility for their own lives.

While speaking at a high school in a wealthy neighborhood in Connecticut, I asked the girls present, “How many of you think you will be responsible for supporting yourselves financially?” About 5% to 10% raised their hands. There were boys in the room, and some girls don’t raise their hands in mixed-gender settings. But even for accounting for that, the numbers were too low. This was in 2018, not 1968. I told them they should all want to be responsible and that 90% would be responsible at some point in their lives.

Solutions

Here are some more ideas on how to attract and retain female clients.

- Be authentic. Women can feel in their gut if the advisor is being straight with them. Be the person you would want your mom to go to.

- Listen, hear and see them.Get to know who they are, what is important to them, and what they are afraid of. Even if they don’t know what questions to ask, tell them, “Think about capital gains and taxes in your portfolio. This is where working with me will add value.”

- Follow their timeline.They are busy doing it all, so it might take them more time to review, process and even run your proposal or suggestions by other friends and confidents. They take longer to close but are worth it; don’t give up. I only give up if I am getting ghosted, meaning they are ignoring my calls, texts and emails. It hurts me because I care for these people. I don’t understand what would make a person never respond again.

- Never do a hard sale. I know that 75% to 85% of men in our industry ask for the business over and over again. But I never wanted to sound like a used car salesperson. I don’t even consider myself a salesperson. Instead, I think of myself as a consultant or an attorney giving advice. They can choose to take it, because it is in their best interest, or reject it. If they reject, this is usually indecision rather than a straight-out rejection. It reminds me of the Alanis Morissette lyric, “It’s the good advice that you just didn’t take.”

- Be empathetic.Put yourself in the client’s shoes and feel what they are feeling. I happen to be an empath, so this is very natural for me, and I am not sure if this skill can be taught. When a client is hurting, I hurt and I want to ease their pain and anxiety. Money is very emotional and tied to so much more than just the money itself. That’s why we are also therapists.

- Teach her, don’t tell her.Similar to the well-known proverb, “If you give a woman a fish, you feed her for a day. If you teach a woman to fish, you feed her for a lifetime.” I am a teacher by trade. Giving and imparting knowledge feels good and like the right thing to do. I always say I teach money instead of history, but sometimes I teach the history of money.

7 Questions Financial Advisors Should Ask Themselves

As you think about your practice and client relationships, here are some more points to consider.

- Am I actively involving both spouses in financial discussions?

- Do I listen to and validate the concerns and goals of my female clients?

- How can I better educate and empower my female clients about their financial options?

- Is my advisory team diverse enough to meet the needs of all clients?

- Am I assuming that my clients understand the financial jargon I use, or am I making an effort to communicate clearly?

- What steps can I take to ensure that my female clients feel heard, respected and valued in our interactions?

- How can I build a relationship of trust with my clients, particularly those who may feel marginalized or overlooked?

Cary Carbonaro, CFP, is a managing wealth advisor and the Women and Wealth ambassador at Ashton Thomas Private Wealth. She advocates for women in the financial industry, which she has been part of for more than 25 years. This article is adapted with her permission from her new book, “Women and Wealth: A Playbook to Empower Clients and Unlock Their Fortune,” published by Wiley.