Written by Cary Carbonaro | Read Original Article Here

I had the privilege of hosting a panel featuring myself, Kimberly Foss from Mercer and Lisa Brown from Corient. We delved into the profound transformation of female breadwinners over time, influenced by changing societal norms, legal shifts and the empowerment of feminist movements. From overcoming legal barriers in the 1930s to challenging entrenched gender roles in subsequent decades, female primary earners have navigated diverse challenges and opportunities.

This article dives into the historical context, cultural shifts and modern considerations surrounding female breadwinners, highlighting the impact on financial advisors working with these clients. We also acknowledge the significant contributions of figures like Claudia Golden to the understanding of women’s economic contributions.

First, I broke down the female breadwinners throughout history.

1930s/40s: Legal Constraints And Gender Bias During The 1930s and 1940s. Women encountered significant legal constraints and gender bias in the workforce. Section 214 of the Economy Act of 1932 stated that female teachers would be fired if they married, reflecting societal norms that prioritized women’s domestic roles over professional pursuits.

1950s: Reinforcing Traditional Gender Roles And Domestic Expectations. The 1950s reinforced traditional gender roles, with women often depicted as homemakers and caregivers in popular culture. Advice columns and media of the time provided tips on how women should prioritize their husbands’ needs and manage household responsibilities, perpetuating entrenched gender norms.

1960s: Feminist Awakening And Challenging Stereotypes. The 1960s marked a turning point with the rise of second-wave feminism, spurred in part by Betty Friedan’s influential book The Feminine Mystique in 1963. This period saw a pushback against traditional stereotypes, as women demanded broader opportunities and equal treatment in both professional and personal spheres. This is also when Virgina Slims came out with the campaign, “You’ve Come a Long Way Baby.”

1970s: Strides In Professionalism And Financial Independence. The 1970s witnessed significant strides in women’s professional advancements, including the graduation of the first class of certified financial planners (CFPs) in 1973. The introduction of the first woman’s credit card in 1974 symbolized increasing financial autonomy and independence for women.

1980s: Cultural Shifts And Empowerment Messages. The 1980s saw cultural shifts towards empowering women, with messages challenging traditional gender roles. Iconic commercials like “I can bring home the bacon, fry it up in a pan, and never let you forget you’re a man” highlighted women’s capabilities as breadwinners while advocating for gender equality.

1990s. As feminist movements evolved in the 1990s, diversity and representation became key themes. It was the rise of the “smart women” like Hiliary Clinton and first female chair of CFP Board, Donna Barwick (1996-97). CFP Board has had eight female chairs since.

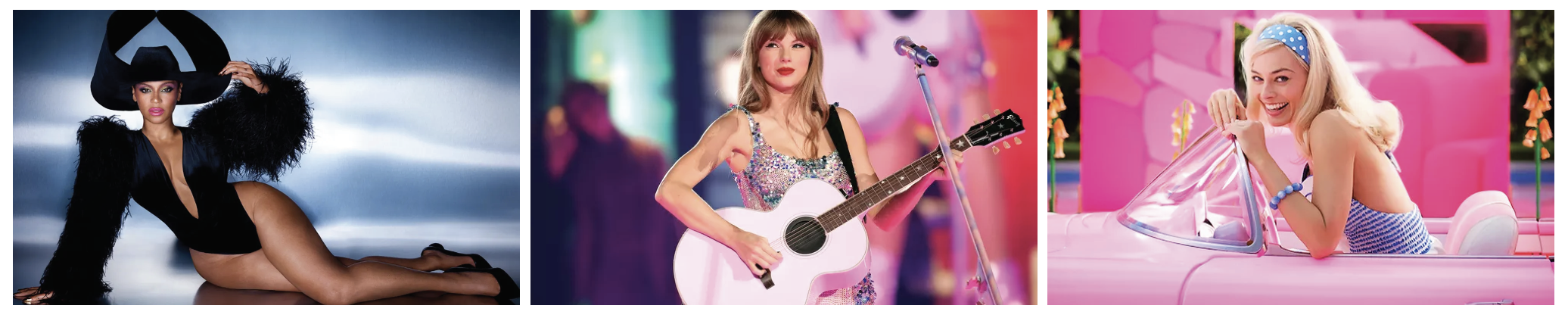

Today: Diversity, Representation And Financial Empowerment. As feminist movements evolved, diversity and representation became key themes. Today, female breadwinners are represented by influential figures like Taylor Swift and Beyoncé, showcasing diverse narratives of financial empowerment and success. Kimberly Foss highlighted this, stating, “Lightning-rod figures like Taylor Swift and Beyoncé have popularized the notion of women who are taking charge, both financially and politically.” In 2023, we also had the Barbie movie breaking records for Margo Robbie and Greta Gerwig. Barbie passed $1 billion and Greta became the first solo female director to reach this milestone. Claudia Golden’s groundbreaking work in gender economics, culminating in her Nobel Prize win in 2023, has had a profound impact on understanding the economic contributions of women. Her research sheds light on the gender-wage gap, occupational segregation and the economic implications of gender inequality. Additionally, financial advisors play a crucial role in supporting and empowering female breadwinners to achieve their financial goals.

The first question for all of us is, “Are you the breadwinner of the home?” All three of us are! Lisa’s husband is a stay-at-home dad to support all of her children. She said he doesn’t fit with the stay-at-home moms or the dads. He said the men look down on him and she said, “It sucks.” I said, “Strong Women scare weak men.”

Our panel discussed many questions for financial advisors when dealing with the strong trend of women becoming breadwinners, which is currently at 40% and climbing.

Key Questions And Considerations For Financial Advisors: Financial advisors must consider several key questions and strategies when working with female breadwinners.

1. Leveraging Cultural Representation: How can advisors leverage cultural representations and influential figures to support and empower female breadwinners in achieving their financial goals?

2. Partner Dynamics In Financial Planning: How do male partners typically react to their female partners becoming primary earners, and how does this dynamic impact financial planning discussions?

3. Intersectionality And Inclusivity: How can advisors address the intersectionality of gender, race and socioeconomic status when advising female breadwinners, recognizing the diverse experiences and challenges faced by different groups?

4. Unique Advantages Of Female Breadwinners: Have advisors encountered unique advantages or opportunities that female breadwinners bring to financial planning conversations?

5. Gender Roles And Financial Decision-Making: Can advisors provide examples of how gender roles and societal expectations influence financial decision-making within families where the woman is the primary earner?

This goes back to some key differences when the advisor is working with a woman. The planning and strategy should incorporate these considerations:

• Women’s longer life span, especially concerning retirement planning

• Women make less and retire with less due to the pay-wage gap

• Women are generally more conservative than men

• Women spend more on healthcare than men in retirement—up to $300K more

• The higher possibility that women will spend more years out of the workforce than male counterparts, due to decisions around child-rearing and also providing care for aging parents

• 75% of caregivers are women, and they typically spend 50% more time in caregiving than male counterparts.

Lisa Brown, from Corient, shared her insight highlighting the importance of mutual respect within financial advisory relationships. She emphasized, “It’s important for advisors to always treat each spouse with the same amount of respect, regardless of who is the breadwinner or who is the one managing the household finances.”

Kimberly Foss, representing Mercer, added valuable perspectives regarding the evolving trends and challenges faced by female breadwinners. She noted, “The trend of female breadwinners isn’t going away. Advisors should focus on empowering women by lifting them up and creating opportunities for growth.”

At the end during questions, one young millennial said, “I think we have come a long way, and I am encouraged that more women are breadwinners and that the numbers are increasing.” I said, “I can’t wait for female breadwinners to become the majority!”

Cary Carbonaro is director of the women and wealth division of ACM Wealth.